Why You Should Consider Cyber Liability Insurance

As cyber-attacks become more frequent and costly, it's important to protect your business and your clients. Having the right insurance can do just that.

Payroll Tax Team Overload? 3 Time Hacks to Give Them Time Back

Managing payroll tax compliance can be time-consuming, given all the complexities involved, leaving your payroll tax team sitting at their desks longer than they'd like to be. Discover three time hacks that can give your team time back in their day to do what they enjoy — at work and at home.

Is ACA Compliance Top of Mind Before You Receive an IRS Notice?

No company wants to receive an ACA (Affordable Care Act) penalty notice from the IRS. There are some key questions you can ask yourself when you sit down to work out the details of the health plan(s) you will offer your employees for the upcoming plan year. Your answers to these questions could save you a hefty penalty two years down the road.

New Pay Options Can Affect How You Garnish Wages

Do you let your employees access their wages before payday? If so, this article offers help with processing their wage garnishments correctly. This article was written in partnership with Vicki Contreras, Sr. Director, Org Enablement, ADP compliance and shared services team.

4 Potential Consequences of Violating Pay Transparency Laws

To help promote pay equity, several states and local jurisdictions have passed pay transparency laws, which require employers to provide pay range information to applicants and employees. Employers who violate these laws may face agency investigations, lawsuits and civil penalties, as well as an obligation to correct any violation.

SECURE 2.0: New Business Tax Incentives for Retirement Plans

The SECURE 2.0 Act was designed to make it easier and more affordable for small businesses to offer employer-sponsored retirement plans. Learn about tax credits that can help offset the costs of a new plan.

Verifying Contractor Licenses What You Should Know

As more organizations rely on an independent contractor workforce, having an onboarding process with the proper guardrails in place can help enable you to verify contractor licenses quickly and effectively.

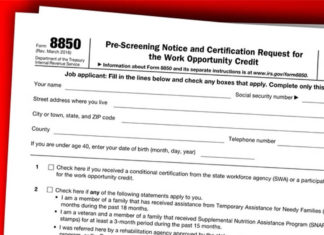

WOTC 101: What Employers Need to Know About the Work Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) represents one of the most underutilized tax credits available to businesses. Explore how to overcome operational obstacles to capturing the WOTC credits for which you may be eligible.

2022 Workforce Trends: What’s Different This Tax Season?

The tax credits that are available both at the individual and business level are proving to be challenging — yet could be advantageous.

Transforming HR Compliance: Less Risk, More Reward

Focus on these three areas to help reduce HR compliance risk exposure while also cutting costs.