by Spark Team

The Work Opportunity Tax Credit (WOTC) represents one of the most underutilized tax credits available to businesses. Explore how to overcome operational obstacles to capturing the WOTC credits for which you may be eligible.

Chances are, as a job prospect, you’ve filled out a job application where you’ve been asked questions about potential government assistance benefits, rehabilitation services, or your status as a U.S. veteran. If so, you may have been screened for eligibility for the Work Opportunity Tax Credit (WOTC).

As an employer, the WOTC program represents one of the most underutilized tax credits available to businesses—one that can reduce a company’s federal tax liability for each WOTC-eligible employee hired.

But all too often however, companies fail to fully capitalize on the benefits of this tax credit—or spend more time and effort than necessary when trying to manage their tax credits.

Let’s explore the basics of the WOTC program—and how employers can make the most of the opportunity to offset federal tax liabilities while minimizing the cost/effort involved.

Putting WOTC to work for your business

WOTC is a federal tax credit program that allows companies to receive tax credits when they hire individuals from defined target groups who have consistently faced significant barriers to employment.

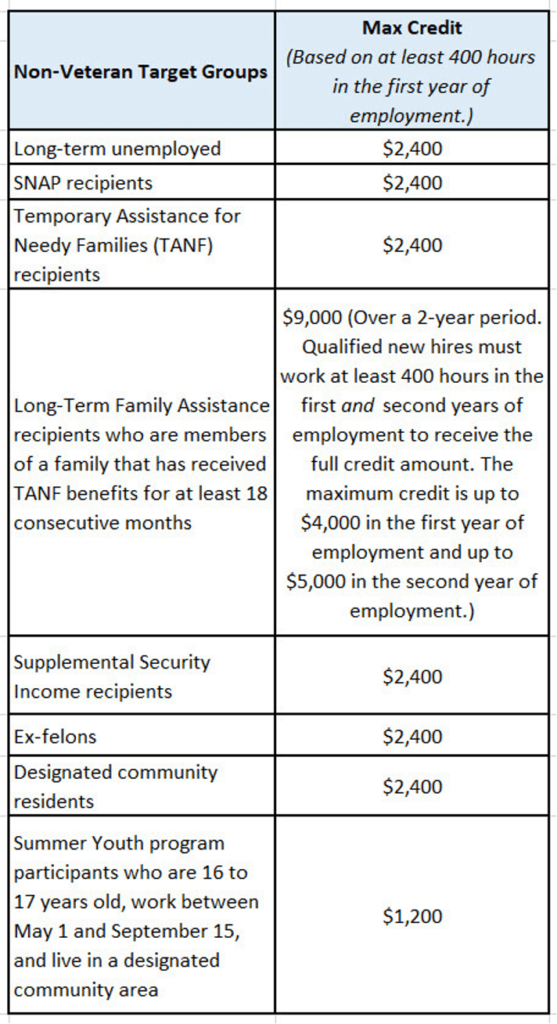

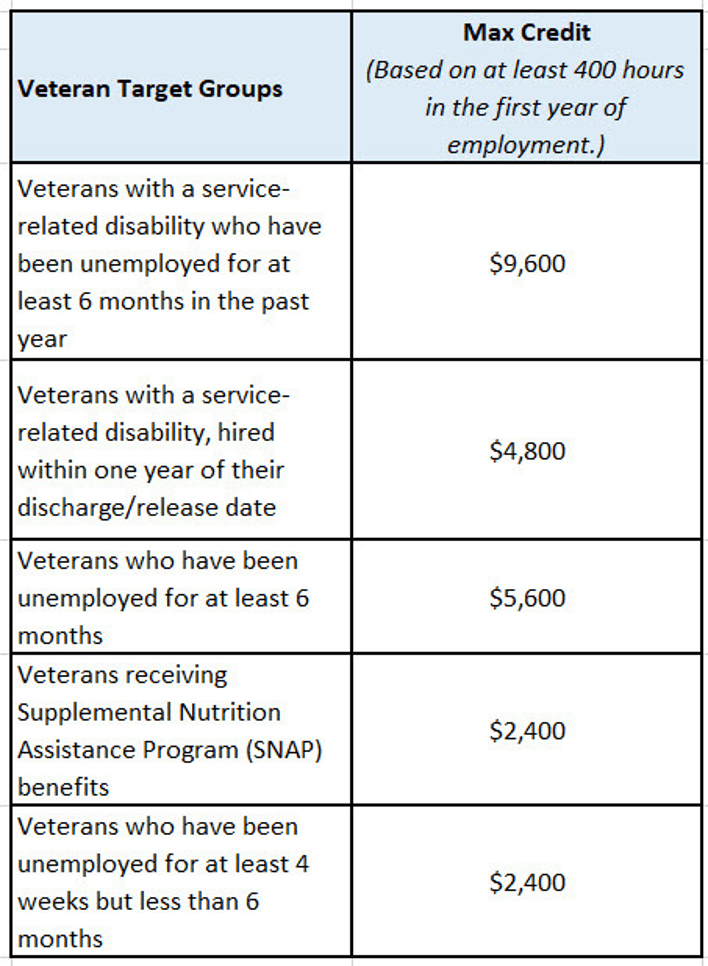

Employers can receive tax credits of up to $9,600 per qualified new hire, depending upon the new hire’s WOTC target group.

The tax credit amount is equal to 40% of the employee’s qualified wages if the employee works at least 400 hours during the first year of employment. If the employee works less than 400 hours, but at least 120 hours, then you can claim a credit equal to 25% of the employee’s qualified wages. Eligible employees MUST work a minimum of 120 hours to qualify. An employer cannot claim the tax credit for rehired employees.

To claim this tax credit, employers must first obtain certification that the employee they have hired is a member of a targeted group.

Claiming the WOTC in 6 steps

Screening applicants to determine WOTC program eligibility, submitting the right paperwork and filing for the tax credit are the basic steps involved in taking advantage of the WOTC. Keeping track of employee hours and maintaining records round out the six basic steps in the process.

The steps themselves are relatively straight-forward, but they can be overwhelming when there are large volumes of applicants and new hires to process. The great news is that the process is one that lends itself well to automation, with workflows that can alert employers to requirements and deadlines.

In a nutshell, employers need to follow this six-step process:

- Find eligible applicants

Employers can actively recruit for WOTC-eligible candidates by contacting the state workforce agency (SWA) or local unemployment office for a list of potential job applicants. - Screen applicants

Employers must have applicants complete the questionnaire on the first page of the IRS Form 8850 on or before the job offer date to see if they qualify for one of the WOTC target groups. - Submit documents

Employers must sign and submit the completed Form 8850 and either ETA Form 9061 or 9062 to the SWA within 28 calendar days of the eligible new hire’s start date. - Monitor hours worked and qualified wages paid

WOTC-certified employees must work at least 120 hours during the first year of employment for an employer to claim credits, which are calculated as a percentage of qualified wages. Employees in the long-term TANF recipient category must work at least 400 hours. - Claim the tax credit

Use IRS Form 5884 when filing annual tax returns to claim the WOTC. - Keep accurate records

Make copies of all the forms and supporting documents submitted to SWAs and correctly track employee hours in case the IRS audits the credits claimed.

Understanding WOTC target groups

WOTC target group definitions and available credits are summarized in the tables below.

Data capture and automatic workflows to track and manage the application process and support compliance requirements can help employers to maximize their WOTC capture while minimizing the cost of supporting qualification, filing and compliance. The biggest hurdles for employers when it comes to securing tax credits under the WOTC program include gathering the information needed to determine whether an applicant is a member of a target group. This information must be captured on or before the day a job offer is made to the applicant. Doing so during the employee application process creates an opportunity to do so in a way that is consistent and captures the right qualifying information without unnecessary manual effort. Capturing some of this information up front even helps companies to forecast their potential benefit.

Putting WOTC to work for you

For more information, contact an ADP WOTC expert by sending an email.

This article originally appeared on SPARK powered by ADP.